State Guides

Guide to Forming an LLC in Connecticut

Follow our free guide to form an LLC in Connecticut

- Pros and Cons of Forming an LLC in Connecticut

- Starting Your Connecticut LLC

- Maintaining Your Connecticut LLC

- Additional Connecticut Resources

Check out our informative two-phase guide on building an LLC in Connecticut and learn everything you need to know about forming your LLC business in Connecticut.

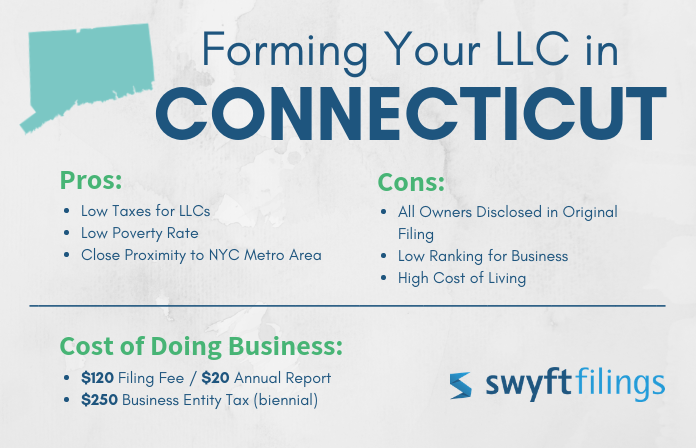

Pros and Cons of Forming an LLC in Connecticut

Pros

Low Taxes for LLCs

Connecticut does not burden small businesses with high tax rates. LLCs are only required to pay a $250 Business Entity Tax every two years.

Low Poverty Rate

Connecticut’s economy may be moving more slowly than other states, but Connecticut’s poverty rate is well below the US average — 9.8% versus 14%.

Close Proximity to NYC Metro Area

Connecticut’s southern cities (Greenwich, Stamford, New Canaan) are within a few hours’ drive of New York City. Recent positive activity in Stamford’s financial district has earned the city the title of “Little Manhattan.”

Cons

All Owners Disclosed in Original Filing

Connecticut state law requires that all members/manager of an LLC be listed in the Certificate of Organization.

Low Ranking for Business

Based on CNBC’s annual “Best States for Business” report, Connecticut does not quite make the cut — high cost of living and poor infrastructure were among the categories that put the state at #37 on the list.

High Cost of Living

Considered one of the more expensive states in the U.S, Connecticut tops the national average by almost 20%, especially in the area of housing — the median cost of homes in Connecticut is $20,000 higher than the average US cost.

Cost of Doing Business

- $120 Filing Fee / $20 Annual Report

- $250 Business Entity Tax (biennial)

Phase One: Starting Your Connecticut LLC

Starting an LLC may not appear overly simple, but the process is not that difficult when you have help. Here are the steps needed to ensure that your Connecticut LLC comes together correctly:

- Step 1: Name your LLC

- Step 2: Establish Ownership of your LLC

- Step 3: Decide on a Registered Agent

- Step 4: File the Certificate of Organization

- Step 5: Create your Operating Agreement

- Step 6: Fill out the paperwork for an EIN

Step 1: Name Your Connecticut LLC

Finding a name for your new business is an important first step in forming your Connecticut LLC. As you narrow down the list of possible company names, there are a few guidelines set by the state and federal government to keep in mind:

Tip: Use a free business name search tool to ensure your company’s desired name is available.

Naming Guidelines

- The official name of your business must end with: Limited Liability Company, Limited Company, LLC, or L.L.C

- Your business name cannot be intentionally misleading to consumers

- The name of your new LLC must not be similar to another organization’s name/trademark

Restrictions

A few restrictions do exist regarding the name of your LLC, depending on the state where you are starting your business.

A few examples include:

- “Lottery” and “Bank” are ineligible for use (any state)

- Terms that represent educational or Veterans’ organizations are restricted

- Terms related to the Armed Forces or civil servants (police, EMT, fire)

LLC business names associated with government and/or financial entities are not always restricted - it depends on the state. Additional paperwork may be required.

URL Availability

In addition to choosing a name for your LLC, creating an online presence for your Connecticut LLC. You can easily check domain name availability at a number of online web services sites.

Step 2: Establish Ownership

The owners of an LLC are not called owners — they are instead referred to either as members or managers depending on the management structure of the business.

LLCs generally have two management structures:

- Member-managed: ownership of business is divided among the members and all parties receive portions of the profits.

- Manager-managed: the appointed manager is the main operator and the members are passive investors who are not actively involved in the daily business operations

After you have selected a name for your business, you then need to choose a management structure and designate the members of the LLC. The rules concerning LLC ownership in Connecticut include:

Required Number of Members

There must be at least one member or manager to form an LLC in Connecticut.

Member Disclosure Requirements

All members of the LLC must be named in the Certificate of Organization

Age Restrictions

LLC members in Connecticut may be of any age.

Residence Restrictions

There are no residency restrictions imposed on LLC members in Connecticut.

Step 3: Find a Registered Agent in Connecticut

The registered agent is necessary for all LLCs formed in Connecticut and cannot be official without filling this position.

What is a registered agent?

A registered agent is a person or business who is authorized to accept official government notices (including the Secretary of State) and service of process notices on behalf of the LLC.

Why do you need a registered agent?

Whenever you start an LLC in Connecticut, the law requires you to appoint a registered agent so that the state government has a consistent contact person for your business.

What are the main requirements for a registered agent?

- The registered agent must have a physical address — not a P.O. Box

- The registered agent must be available during business hours

Who can be a registered agent in Connecticut?

- A resident with a physical address in Connecticut

- An LLC or corporation that is licensed to conduct business in Connecticut

Is the registered agent’s contact information publicly accessible?

The name and contact information of the LLC’s registered agent is a matter of public record.

Can I be my own registered agent for my business?

You are legally allowed to be your own registered agent as long as you have a physical address in Connecticut.

Is being my own registered agent discouraged?

Since the registered agent’s name and address are publicly listed, LLC business owners who choose to be their own registered agent risk compromising their personal information.

Tip: Avoid the hassles and choose Swyft Filings to fill the registered agent needs for small businesses in Connecticut. Find more information here.

Step 4: File the Certificate of Organization

Connecticut LLCs become official and legal when they file the required Certificate of Organization with the Secretary of State.

What is the Certificate of Organization?

The Certificate of Organization is a legally binding foundational document that is filed with the Connecticut state government to lawfully form your LLC.

Why do I need the Certificate of Organization?

Your LLC business in Connecticut will not be legally recognized by the Secretary of State without filing this document.

What is the cost of filing the Certificate of Organization?

The filing fee for Connecticut is $120.

What information is included in the Certificate of Organization?

- The name and address of the LLC

- The type of registered agent (personal or commercial)

- The name of the members or organizer filing the paperwork

- The name and location of the registered agent

- The chosen LLC management structure

- The duration of the LLC (perpetual or not)

Additional Connecticut Filing Requirements — Professional Service Businesses

Connecticut also allows professional service businesses to form an LLC.

The following professions may choose to form an LLC:

- Accountants

- Attorney

- Physicians (general, surgeon, podiatrist, dentist, optometrist, chiropractor, physical therapist)

- Professional Counselors and Psychologists

- Architects and Engineers

- Veterinarians

A few points to consider:

- All members of the professional LLC must be licensed in the profession of the business.

- The professional LLC is only allowed to provide services for which the business was formed.

- The members are still subject to whichever licensing boards govern the LLC’s profession.

Step 5: Create an LLC Operating Agreement

Although an LLC Operating Agreement is not required to form an LLC in Connecticut, it is a vital necessity that adds structure and projects a sense of professionalism.

What is an LLC Operating Agreement?

The LLC Operating Agreement is a legal document that defines the rights and responsibilities of each person involved in the business and lays out the details involving how the business will operate.

Why do I need an LLC Operating Agreement?

The LLC Operating Agreement ensures the stability and structure of the LLC and reduces future disputes since it defines the roles of the business’s members and provides direction for daily operations.

Do I need to file the LLC Operating Agreement?

You do not need to file the Operating Agreement with the state; it is for the benefit of your LLC and remains in-house.

What goes into an LLC Operating Agreement?

While there is not a set rule of what must be included in your LLC operating Agreement, most documents include the following the information:

- List of the members/managers and their roles

- Designation of authority in the LLC

- Initial capital contributions of the members

- Voting designations and percentages of the members

- Member transfer/addition rules and restrictions

- Distribution of profits

- Meeting schedule

Tip: Get a customized LLC Operating Agreement for your small business with Swyft Filings. Add structure to your LLC now.

Step 6: Obtain an EIN

The state of Connecticut requires an EIN for any business that has/plans to have employees. Additionally, most banks and financial institutions require the EIN in order to open any accounts.

What is an EIN?

The EIN is a nine-digit number that is assigned to your business by the Internal Revenue Service (IRS). The EIN identifies your business with the government much like a personal Social Security number.

What does EIN stand for?

EIN is an acronym for Employer Identification Number. It is also known as a Federal Tax ID.

Are all businesses required to have an EIN?

Federal law dictates that certain types of business entities register for an EIN:

- Any business with employees (even if owned by one person)

- Any business with more than one member

- A partnership (LLC or C-corp)

Please Note: A sole proprietorship is not required to have an EIN, but it is still recommended.

Why does my LLC business need an EIN?

The more common reasons you would need an EIN are:

- To hire employees

- To open a bank account in the U.S.

- To file your company’s taxes

- To pay independent contractors

In short, if you make money through your business and it has employees, you must have an EIN.

Is the EIN publicly listed?

The EIN for your LLC will be part of public record.

Can I use my Social Security Number as the EIN?

If you are a sole proprietorship who wants an EIN for your business, you can elect to use your social security number; however, your EIN is part of public record.

Swyft Filings offers EIN services for small businesses in Connecticut. Find more information here.

Phase Two: Maintaining Your Connecticut LLC

After the completion of phase one of setting up your Connecticut LLC, it is time to move your business forward and stay compliant and ready for customers.

The next few steps are:

- Step 1: Register for Taxes in Connecticut

- Step 2: Apply for Needed Permits and Licenses

- Step 3: File the Annual Report for your LLC

- Step 4: Request a Certificate of Good Standing

Step 1: Register for Connecticut State Taxes

The taxes for LLCs in Connecticut may include varying payments, depending on the type of business. All LLCs must pay the biennial Business Entity Tax (BET):

Fee: $250

Due Date: April 15th following the close of the taxation period (odd year)

Taxation Period: Biennial cycles

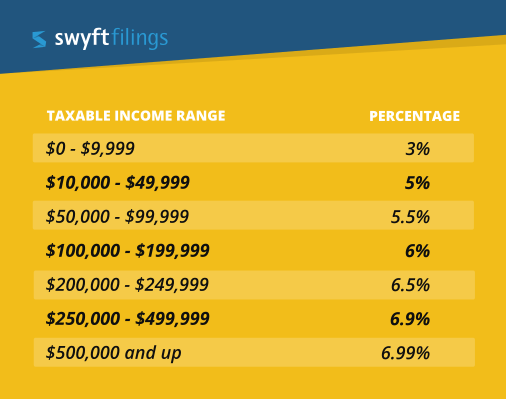

State Income Taxes

The table below shows the tax rates for Connecticut:

Corporation Tax Information

You can also choose to have your LLC taxed as a corporation; if so, you will be responsible for paying corporate taxes on your business’s earnings.

Connecticut’s corporation business tax (CBT) charges businesses the highest amount from:

- 7.5% of net income

- .0031% of capital holdings OR

- $250 minimum tax

Please Note: The minimum corporation business tax fee is $250.

Additional Tax Information

Other taxes your LLC may need to pay include:

- Sales and Use Tax at 6.35%

- Employee Withholding Tax

- Unemployment Tax

Step 2: Obtain Business Licenses and Permits

The licenses and permits required for an LLC in Connecticut can vary depending on a number of variables:

- Location (city and county)

- Type of Business

- Industry

Tip: If you would like to see more in-depth information on licenses and permits, please feel free to visit the content in our learning library that covers business licenses and permits.

Certain LLC businesses in Connecticut will need a Sales and Use Tax Permit:

- Any business selling physical goods

- Any business that sells taxable services

- Hotels, motels, B&Bs, and other lodging establishments

Please Note: Failure to obtain a sales tax permit can result in a $500 fine.

Step 3: File an Annual Report

All Connecticut LLCs must file an annual report with the Department of State. The purpose of the annual report is to keep the business’s information and “good standing” status updated with the state.

What is an annual report?

An annual report is a legal document that is filed with the Secretary of State on a yearly basis that is designed to keep your business’s information current with the state.

What kind of information is in the annual report?

The information requested in the annual report is similar to what is in the Articles of Organization:

- The name and address of the business

- The name and address of the registered agent

- The business’s EIN

Is the annual report part of public record?

The annual report filed on behalf of your LLC is a matter of public record.

Fees and Due Date

Fee: $20

Due Date: Anniversary month that LLC was formed

Frequency: every year

Implications of Late Filings: LLC status changed to “Not in Good Standing”

Please Note: Even though Connecticut does not charge a late fee for a delinquent annual report, the downgraded status can negatively impact your company’s ability to conduct business in the state.

Swyft Filings helps you stay compliant by providing stress-free solutions. File your annual report with us today.

Step 4: Obtain a Certificate of Good Standing

There is one final step in making sure your Connecticut LLC is ready for business — securing a Certificate of Good Standing.

What is a Certificate of Good Standing?

The Certificate of Good Standing is an official notification from the government that confirms your entity has been properly filed and is in compliance with all state regulations.

Who issues the Certificate of Good Standing?

The Certificate of Good Standing is generally issued by the Secretary of State.

When can I request a Certificate of Good Standing for my business?

You can request a Certificate of Good Standing after your LLC is officially formed through the Secretary of State.

Why do I need a Certificate of Good Standing?

The majority of financial institutions and businesses may require proof that your new business is fully compliant with the state. Obtaining a Certificate of Good Standing provides your LLC with a “seal of approval” from the Secretary of State.

Additionally, some states require a Certificate of Good Standing before a business can apply for Foreign Qualification.

Does the Certificate of Good Standing have an expiration date?

The Certificate of Good Standing does not expire/does not need to be renewed.

Swyft Filings can create a Certificate of Good Standing for your Connecticut LLC. Click here for more information.