State Guides

Guide to Forming an LLC in Massachusetts

Follow our free guide to form an LLC in Massachusetts

- Pros and Cons of Forming an LLC in Massachusetts

- Starting Your Massachusetts LLC

- Maintaining Your Massachusetts LLC

- Additional Massachusetts Resources

The full process of starting an LLC in Massachusetts covers multiple steps. We have divided our comprehensive LLC guide into two phases to help you understand the whole LLC formation journey.

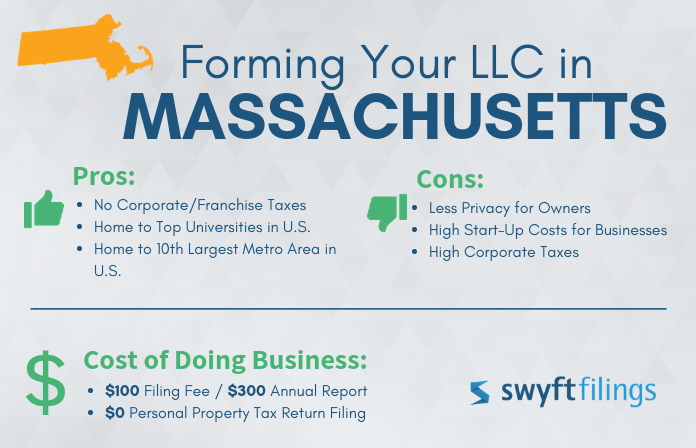

Pros and Cons of Forming an LLC in Massachusetts

Pros

No Corporate/Franchise Taxes

Massachusetts does not require LLCs to pay a corporate or franchise tax. The only taxes owed on the LLC’s revenue is the personal income tax paid by the members.

Home to Top Universities in U.S.

Massachusetts is home to two of the most prestigious universities in the country - Massachusetts Institute of Technology (MIT) and Harvard University. MIT and Harvard were both recently ranked as #1 and #3 respectively.

Home to 10th Largest Metro Area in U.S.

The Boston/Cambridge/Newton is the tenth largest metro area in the United States with a growing population of roughly 4.85 million and an impressive $450 billion GDP that grew by almost $20 billion from 2016 to 2017.

Cons

Less Privacy for Owners

Massachusetts is among the states that require full disclosure of an LLC’s members in the incorporation paperwork.

High Start-Up Costs for Businesses

The filing and annual reports fees imposed by Massachusetts are among the highest in the country - $500 to form a business and $500 to file the annual statement.

High Corporate Taxes

Corporations and some LLCs in Massachusetts are required to pay two hefty taxes - an 8% corporate tax and an additional .026% property tax.

Cost of Doing Business

- $500 filing fee / $500 annual statement

- No corporate/franchise tax

Phase One: Starting Your Massachusetts LLC

Forming an LLC is not as difficult as you may think, especially when you have professional, experienced help. Start the process for your Massachusetts LLC today with these steps:

- Step 1: Name your LLC

- Step 2: Establish Ownership of your LLC

- Step 3: Decide on a Resident Agent

- Step 4: File the Certificate of Organization

- Step 5: Create your Operating Agreement

- Step 6: Register for an EIN

Step 1: Name Your Massachusetts LLC

Creating your Massachusetts LLC begins with selecting a name. While making your list of possibilities, be aware that there are state and federal guidelines concerning the use of certain words in business names.

Tip: Use a free business name search tool to ensure your company’s desired name is available.

Business Name Guidelines

- The official name of your business must end with: Limited Liability Company, Limited Company, LLC, or L.L.C.

- Your business name cannot be intentionally misleading to consumers

- The name of your new LLC must not be similar to another organization’s name/trademark

Restrictions

- “Lottery” and “Bank” are ineligible for use (any state)

- Terms that represent educational or Veterans’ organizations are restricted

- Terms related to the Armed Forces or civil servants (police, EMT, fire)

LLC business names associated with government and/or financial entities are not always restricted - it depends on the state. Additional paperwork may be required.

URL Availability

You also need a choose a domain name for your LLC’s website — having an online presence is especially important in this current business culture. Check name availability through online hosting sites.

Step 2: Establish Ownership

The owners of an LLC are considered members and/or managers. While all LLCs have members, not all will have managers — it depends on the management structure of the business.

LLC Management Structures:

- Member-managed: All members participate in operating and making decisions for the LLC

- Manager-managed: An appointed manager oversees the daily operations of the LLC and the members are not actively involved.

Massachusetts LLC Member Guidelines

Required Number of Members

There must be at least one member or manager to form an LLC in Massachusetts.

Member Disclosure Requirements

All managers/members of the LLC must be included in the Certificate of Organization.

Age Restrictions

LLC members in Massachusetts may be of any age.

Residence Restrictions

There are no residency restrictions imposed on LLC members in Massachusetts.

Step 3: Find a Resident Agent in Massachusetts

All Massachusetts LLCs must appoint a resident agent. Your business cannot be official without filling this position.

What is a resident agent?

A resident agent (also called a registered agent) is a person or business who accepts government-related mail and service of process notices on behalf of the LLC.

Why do you need a resident agent?

Massachusetts law requires you to appoint a resident agent so that the state government has a consistent contact person for your LLC.

What are the main requirements for a resident agent?

- The resident agent needs a physical address — not a P.O. Box

- The resident agent is available during business hours.

Who can be a resident agent in Massachusetts?

- A state resident with a physical address in Massachusetts

- An LLC or corporation that is licensed to conduct business in Massachusetts

Is the resident agent’s contact information publicly accessible?

The name and contact information of the LLC’s resident agent is a matter of public record.

Can I be my own resident agent for my business?

You can be your own resident agent as long as you have a physical address in Massachusetts.

Is being my own resident agent discouraged?

LLC business owners risk compromising their personal information if they choose to act as the resident agent for the business.

Tip: Avoid the hassles and choose Swyft Filings to fill the resident agent needs for small businesses in Massachusetts. Find more information here.

Step 4: File the Certificate of Organization

The most important step in creating your Massachusetts LLC is filing the Certificate of Organization with the Secretary of the Commonwealth.

What is the Certificate of Organization?

The Certificate of Organization is a legally binding document that is filed with the state government to legally form your LLC.

Why do I need the Certificate of Organization?

Your Massachusetts LLC will not be legally recognized by the Secretary of the Commonwealth without filing this document. Consider the Certificate of Organization as part of your LLC’s foundation.

What information is included in the Certificate of Organization?

- The name and address of the LLC

- The name and location of the resident agent

- The name of the party filing the paperwork

- The character of the business/statement of purpose

- The chosen LLC management structure

- The contact information of the LLC members

Additional Massachusetts Filing Requirements — Professional LLCs

Professional service businesses may form a specific type of LLC in Massachusetts known as a Professional Limited Liability Company (PLLC).

Examples of professional services businesses:

- Accountants

- Attorneys

- Physicians/Medical Professionals

- Professional Counselors and Psychologists

- Architects and Engineers

- Veterinarians

- Social Workers

A few points to consider:

- All members of the PLLC must be licensed in the profession of the business.

- The PLLC is only allowed to provide services for which the business was formed.

- The members are still subject to whichever licensing boards govern the PLLC’s profession.

Step 5: Create an LLC Operating Agreement

An LLC Operating Agreement may be not required by the state, but it is still necessary for the successful formation of your Massachusetts LLC.

What is an LLC Operating Agreement?

The LLC Operating Agreement is an in-house legal document that defines the rights and responsibilities of the members/managers and details the business’s operating procedures.

Why do I need an LLC Operating Agreement?

The Operating Agreement is necessary for your Massachusetts LLC because it provides structure for the business, protects business assets from creditors, and reduces disputes among members.

Do I need to file the LLC Operating Agreement?

You do not need to file the Operating Agreement with the state; it is for the benefit of your LLC and remains in-house.

What goes into an LLC Operating Agreement?

Even though your LLC’s Operating Agreement should be unique to your business, most documents include the following information:

- List of the members/managers and their roles

- Designation of authority in the LLC

- Initial capital contributions of the members

- Voting designations and percentages of the members

- Member transfer/addition rules and restrictions

- Distribution of profits

- Meeting schedule

Tip: Get a customized LLC Operating Agreement for your small business with Swyft Filings. Add structure to your LLC now.

Step 6: Register for an EIN

The majority of Massachusetts-formed businesses must register for an EIN. Your Massachusetts LLC will not be able to conduct business without this ID.

What is an EIN?

The EIN, which stands for Employer Identification Number, is a nine-digit number assigned to your business by the Internal Revenue Service (IRS). Also known as a Federal Tax ID, the EIN is similar to a personal Social Security number.

Are all businesses required to have an EIN?

Federal law dictates that certain types of business entities register for an EIN:

- Any business with employees (even if owned by one person)

- Any business with more than one member

- A partnership (LLC or C-corp)

Please Note: A sole proprietorship is not required to have an EIN, but it is still recommended.

Why does my LLC business need an EIN?

The more common reasons you would need an EIN are:

- To hire employees

- To open a bank account in the U.S.

- To file your company’s taxes

- To pay independent contractors

In short, if you make money through your business and employ anyone other than yourself, you must have an EIN.

Is the EIN publicly listed?

The EIN for your LLC will be part of public record.

Can I use my Social Security Number as the EIN?

If you are a sole proprietorship who wants an EIN for your business, you can elect to use your social security number; however, your EIN is part of public record.

Swyft Filings offers EIN services for small businesses in Massachusetts. Find more information here.

Phase Two: Maintaining Your Massachusetts LLC

Once you have completed the initial phase of the Massachusetts LLC formation process, you are ready for the next phase that prepares your LLC for daily business operations. The next few steps are:

- Step 1: Register for the necessary taxes in Massachusetts

- Step 2: Apply for Permits and Licenses

- Step 3: File the Annual Report for your LLC

- Step 4: Request a Certificate of Legal Existence

Step 1: Register for Massachusetts State Taxes

Massachusetts is among the states that does not impose a corporate or franchise tax on LLCs. The LLC members are still required to pay state and federal income taxes on their earnings.

State Income Taxes

The state income tax for Massachusetts is a flat rate of 5.05%.

Corporate Tax Information

You can also choose to have your LLC taxed as a corporation; if so, you will be responsible for paying the corporate income tax rate on your business’s earnings. Massachusetts corporations are levied with two taxes: a corporate excise tax and a property tax on all business assets located in the state.

Corporate Excise Tax: 8% with a minimum payment of $456 due

Property Tax: $2.60 for every $1,000 of business-owned assets located in MA

Additional Tax Information

Other taxes your LLC may need to pay:

- Sales and Use Tax at 6.25%

- Employee Withholding Tax

- Unemployment Tax

Step 2: Obtain Business Licenses and Permits

The licenses and permits required for an LLC in Massachusetts can vary, depending on a number of variables:

- Location (city and county)

- Type of Business

- Industry

Tip: If you would like to see more in-depth information on licenses and permits, please feel free to visit the content in our learning library that covers business licenses and permits.

Step 3: File an Annual Report

All businesses formed in Massachusetts are required to file an annual report with the Secretary of the Commonwealth.

What is an annual report?

An annual report is a legal form that updates/maintains your business’s information current with the state and is filed with the Secretary of the Commonwealth on a periodic/yearly basis.

What kind of information is in the annual report?

The information requested in the annual report is similar to what was listed in the Certificate of Organization:

- The name and address of the business

- The name and address of the resident agent

- The names of the members

- The business’s EIN

Is the annual report part of public record?

The annual report filed on behalf of your LLC is a matter of public record.

Fees and Due Date

Fee: $500

Due Date: Anniversary date of LLC formation

Implications of Late Filings: marked as delinquent; eventual dissolution

Swyft Filings helps you stay compliant by providing stress-free solutions. File your annual report with us today.

Step 4: Request a Certificate of Legal Existence

After your Massachusetts LLC is ready for business, the last step left is obtaining a Certificate of Legal Existence for your LLC.

What is a Certificate of Legal Existence?

The Certificate of Legal Existence, also known as a Certificate of Good Standing, is an official notification that proves your LLC is in proper compliance with all state regulations.

Who issues the Certificate of Legal Existence?

The Certificate of Legal Existence is issued to the LLC by the Secretary of the Commonwealth.

When can I request a Certificate of Legal Existence for my business?

You can request a Certificate of Legal Existence from the Secretary of the Commonwealth after your LLC is officially formed.

Why do I need a Certificate of Legal Existence?

Many businesses and financial institutions want proof that your LLC is in good standing with the state government and the Certificate of Legal Existence provides a measure of security.

Does the Certificate of Legal Existence have an expiration date?

The Certificate of Legal Existence does not expire/does not need to be renewed.

Swyft Filings can create a Certificate of Legal Existence for your Massachusetts LLC. Click here for more information.