State Guides

Guide to Forming an LLC in New York

Follow our free guide to form an LLC in New York

- Pros and Cons of Forming an LLC in New York

- Starting Your New York LLC

- Maintaining Your New York LLC

- Additional New York Resources

Should you form your LLC in New York? We’ve collected the relevant information that will help you make this decision.

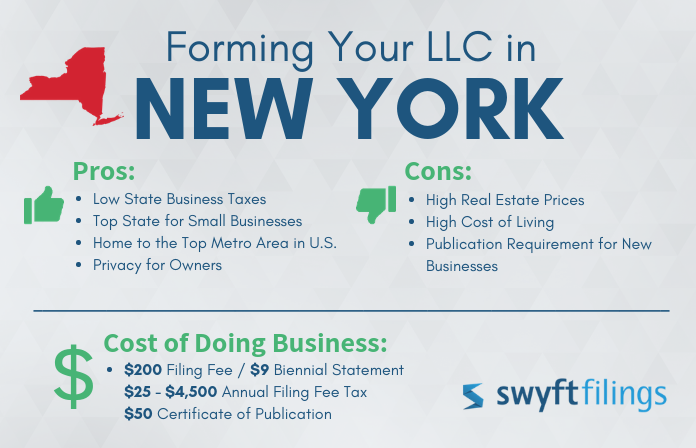

Pros and Cons of Forming an LLC in New York

Pros

Low State Business Taxes

New York’s tax structure for LLC businesses is low—the AFF tax scale starts at $25 (minimum) and caps at $4,500. Traditional LLCs are not required to pay the state’s complicated corporate franchise tax.

Top State for Small Businesses

According to reports in 2016, 99.8% of the businesses in New York are small businesses. Small businesses also employ over half of the state’s private workforce. New York City has climbed to the top of the list as the best city in the US for small businesses, climbing above Los Angeles, San Jose, and Austin.

Home to the Top Metro Area in U.S.

New York City is already on top as the largest city in the nation with almost 9 million residents, but the NYC metro area (NYC/Newark/Jersey City) is also #1 with a GDP over $1.4 trillion. The economy of the state itself is also fairing well with a total gross domestic product of more than $1.5 trillion.

Privacy for Owners

New York does not require disclosure of the LLC’s members in the incorporation paperwork. The LLC may select an organizer to sign and filed the paperwork with the Secretary of State.

Cons

High Real Estate Prices

New York, and specifically NYC, is one of the most expensive places to live in the US — Manhattan property costs average a little over $1,700 per square foot. The average rent for a house in Brooklyn is almost $3,000 and the average sale price for a home is almost $800,000. For businesses that want to rent office space—the average cost per square foot is over $6.00; $5,000 a month translates to barely 800 square feet of office space.

High Cost of Living

New York is among the most expensive states in the country, particularly because New York City is among the most expensive cities in the world to call home. Recent reports ranked NYC’s cost of living at 11th out of 445 cities around the globe. Within the U.S, NYC is over 50% more expensive than Houston.

Publication Requirement for New Businesses

New York is one of only a few states that requires newly formed LLCs to publish a notice of formation in two newspapers for six consecutive weeks. The publications are chosen by the County Clerk’s office and the cost of publication can be anywhere from $200 to over $1,500.

Cost of Doing Business

- $200 filing fee / $9 biennial statement

- $25 - $4,500 Annual Filing Fee Tax

- $50 certificate of publication

Phase One: Starting Your New York LLC

Forming an LLC in New York is not nearly as daunting as it seems. There is the necessary list of steps that ensures that your new business is properly formed:

- Step 1: Name your LLC

- Step 2: Establish the Ownership of your LLC

- Step 3: Decide on a Registered Agent

- Step 4: File the Articles of Organization

- Step 5: Create your Operating Agreement

- Step 6: Register for an EIN

- Step 7: File the Certificate of Publication

Step 1: Name Your New York LLC

Choosing a name your business is the first step in forming your New York LLC. Be aware — state and federal governments regulations and restrictions exist regarding the use of certain words in business names.

Tip: Use a free business name search tool to ensure your company’s desired name is available.

Business Name Guidelines

- The official name of your business must end with: Limited Liability Company, Limited Company, LLC, or L.L.C.

- Your business name cannot be intentionally misleading to consumers

- The name of your new LLC must not be similar to another organization’s name/trademark

Restrictions

- “Lottery” and “Bank” are ineligible for use (any state)

- Terms that represent educational or Veterans’ organizations are restricted

- Terms related to the Armed Forces or civil servants (police, EMT, fire)

LLC business names associated with government and/or financial entities are not always restricted - it depends on the state. Additional paperwork may be required.

URL Availability

Set up your LLC’s online presence by selecting a domain name for the website. You can easily check domain name availability at a number of online web services sites.

Step 2: Establish Ownership

The owners of an LLC are referred to as members and/or managers, depending on the management structure of your business.

LLC Management Structures:

- Member-managed: All members participate in operating and making decisions for the LLC

- Manager-managed: An appointed manager oversees the daily operations of the LLC and the members are not actively involved.

New York LLC Member Guidelines

Required Number of Members

There must be at least one member or manager to form an LLC in New York.

Member Disclosure Requirements

An organizer/authorized representative may sign and file the Articles of Organization in place of the LLC members.

Age Restrictions

LLC members in New York may be of any age.

Residence Restrictions

There are no residency restrictions imposed on LLC members in New York.

Step 3: Find a Registered Agent in New York

The registered agent is a necessary part of all LLCs formed in New York. Your business will not be considered official without this position.

What is a registered agent?

A registered agent is a person or business who receives all official government mail and service of process notices on behalf of the LLC.

Why do you need a registered agent?

New York law requires you to appoint a registered agent so that the state government has a consistent contact person for your LLC.

What are the main requirements for a registered agent?

- The registered agent must have a physical address — not a P.O. Box

- The registered agent must be available during business hours

Who can be a registered agent in New York?

- A state resident with a physical address in New York

- An LLC or corporation that is licensed to conduct business in New York

Can I be my own registered agent for my business?

You are legally allowed to be your own registered agent as long as you have a physical address in New York.

Is being my own registered agent discouraged?

Since the registered agent’s name and address are publicly listed, LLC business owners who choose to be their own registered agent risk compromising their personal information.

Tip: Avoid the hassles and choose Swyft Filings to fill the registered agent needs for small businesses in New York. Find more information here.

Step 4: File the Articles of Organization

In order to legally and officially form your LLC in New York, you need to file the Articles of Organization.

What is the Articles of Organization?

The Articles of Organization is a legally binding document that is filed with the state government to officially and legally form your LLC.

Why do I need the Articles of Organization?

Your New York LLC business will not be legally recognized by the Secretary of State without filing this document. Consider the Articles of Organization as part of your LLC’s foundation.

What information is included in the Articles of Organization?

- The name of the LLC

- The location of the LLC (including county)

- The name and location of the registered agent

- The chosen LLC management structure

- The name and contact information of the organizer

- The statement of purpose

Other New York Filing Requirements — Professional Service Businesses

New York permits certain professional service businesses to form a Professional Limited Liability Company (PLLC).

The following professions generally form PLLCs:

- Accountants

- Attorneys

- Physicians and Medical Professionals

- Professional Counselors and Psychologists

- Architects and Engineers

- Veterinarians

- Social Workers

A few points to consider:

- All members of the PLLC must be licensed in the profession of the business.

- The PLLC is only allowed to provide services for which the business was formed.

- The members are still subject to whichever licensing boards govern the PLLC’s profession.

Step 5: Create an LLC Operating Agreement

New York is one of only a few states that require LLCs to have an Operating Agreement even though the document is not filed with any state office.

What is an LLC Operating Agreement?

The LLC Operating Agreement is a legally binding document that discusses the rights and responsibilities of the members/managers and lays out the details of the business’s operating procedures.

Why do I need an LLC Operating Agreement?

The LLC Operating Agreement creates stability in the business by defining the roles of the business’s members and provides direction for decision-making and voting privileges; in turn, the agreement reduces future disputes and lawsuits.

Do I need to file the LLC Operating Agreement?

You do not need to file the Operating Agreement with the state; it is for the benefit of your LLC and remains in-house.

What goes into an LLC Operating Agreement?

While there is not a set rule of what must be included in your LLC Operating Agreement, most documents include the following information:

- List of the members/managers and their roles

- Designation of authority in the LLC

- Initial capital contributions of the members

- Voting designations and percentages of the members

- Member transfer/addition rules and restrictions

- Distribution of profits

- Meeting schedule

Tip: Get a customized LLC Operating Agreement for your small business with Swyft Filings. Add structure to your LLC now.

Step 6: Obtain an EIN

New York requires an EIN for most businesses in the state. Your business may not be able to operate without it.

What is an EIN?

The EIN, which stands for Employer Identification Number, is a nine-digit number that the IRS assigns to your business for identification purposes. Also known as a Federal Tax ID, the EIN works somewhat like a personal Social Security number.

Are all businesses required to have an EIN?

Federal law dictates that certain types of business entities register for an EIN:

- Any business with employees (even if owned by one person)

- Any business with more than one member

- A partnership (LLC or C-corp)

Please Note: A sole proprietorship is not required to have an EIN, but it is still recommended.

Why does my LLC business need an EIN?

The more common reasons you would need an EIN are:

- To hire employees

- To open a bank account in the U.S.

- To file your company’s taxes

- To pay independent contractors

In short, if your business brings in any money and you have employees, you must register for an EIN.

Is the EIN publicly listed?

The EIN for your LLC will be part of public record.

Can I use my Social Security Number as the EIN?

If you are a sole proprietorship who wants an EIN for your business, you can elect to use your social security number; however, your EIN is part of public record.

Swyft Filings offers EIN services for small businesses in New York. Find more information here.

Step 7: File a Certificate of Publication

New York requires that all newly formed businesses owners publish a notice of business formation in two different newspapers (one daily and one weekly publication ) for six consecutive weeks.

More Publication Facts:

- The LLC may publish the Articles of Organization

- The newspapers are selected by the County Clerk

- The cost for publication varies

- The deadline is 120 days within LLC formation

- The Certificate of Publication fee is $50

At the end of the run, each newspaper provides the LLC with an Affidavit of Publication that will be submitted to the Secretary of State along with the Certificate of Publication form.

Maintaining Your New York LLC

Once the initial phase of creating your New York LLC is finished, it is time to move on to the next part of the process to get your business ready for operation.

- Step 1: Register for New York State Taxes

- Step 2: Apply for Permits and Licenses

- Step 3: File a Biennial Statement

- Step 4: Request a Certificate of Status

Step 1: Register for New York State Taxes

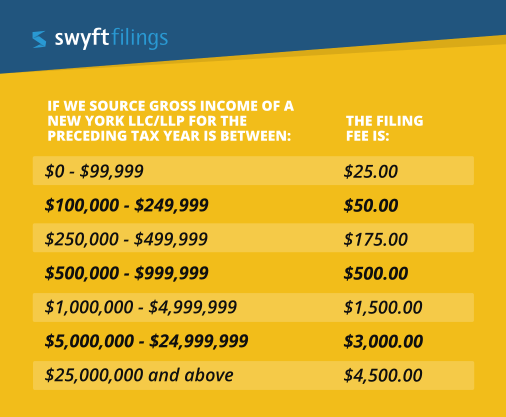

All LLCs formed in New York are required to pay the Annual Filing Fee (AFF). The fee is on a sliding scale and depends on the business’s annual gross income. Please see the chart below:

The annual filing fee is due three months following the close of your LLCs tax year, on the 15th.

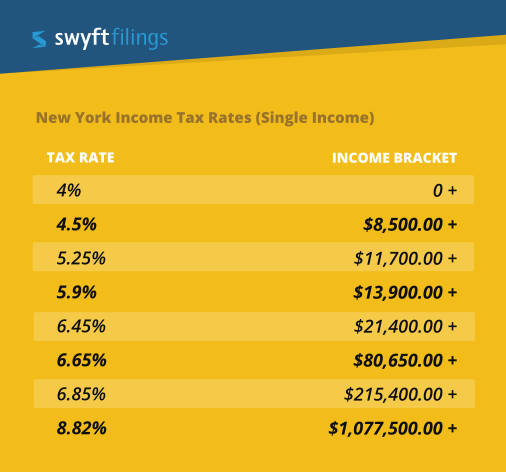

State Income Taxes

LLC members are also required to pay state and federal income taxes on their earnings. New York has a tiered income tax rate that can runs from 4% to 8.82%:

Corporate Tax Information

You can also choose to have your LLC taxed as a corporation; if so, you are responsible for paying the franchise tax for general corporate entities. The tax fees vary and are based on the highest amount from the following three options:

- Corporate Income Base = 6.5%

- Business Capital Base = .100%

- Fixed Dollar Minimum (FDM) tax = $25 to $200,000

Additional Tax Information

Other taxes your LLC may need to pay:

- Sales and Use Tax at 8.87%

- Employee Withholding Tax

- Unemployment Tax

Step 2: Obtain Business Licenses and Permits

The licenses and permits required for an LLC in [state] can vary, depending on a number of variables:

- Location (city and county)

- Type of Business

- Industry

If you would like to see more in-depth information on licenses and permits, please feel free to visit the content in our learning library that covers business licenses and permits.

Step 3: File a Biennial Statement

All businesses formed in New York are required to file a biennial statement with the Secretary of State.

What is a biennial statement?

A biennial statement, also known as an annual report, is a legal form that is filed with the Secretary of State to keep your business’s information current with the state.

What kind of information is in the biennial statement?

The information requested in the biennial statement is similar to what was listed in the Articles or Organization:

- The name and address of the business

- The name and address of the registered agent

- The Department of State Number (DOS ID Number)

Is the biennial statement part of public record?

The biennial statement filed on behalf of your LLC is a matter of public record.

Fees and Due Date

Fee: $9

Due Date: Every 2 years during the annversary month of original LLC formation

Implications of Late Filings: Business status changed to “Delinquent”

Swyft Filings helps you stay compliant by providing stress-free solutions. File your biennial statement with us today.

Step 4: Obtain a Certificate of Status

Requesting a Certificate of Status (also known as a Certificate of Good Standing) is one of the most common and acceptable ways to verify your New York LLC.

What is a Certificate of Status?

The Certificate of Status is an official notification from the Secretary of State that confirms your entity has been properly filed and is in compliance.

Why should I obtain a Certificate of Status?

Many banks and businesses will request a Certificate of Status as part of the due diligence process before moving forward with any transactions or contracts.

Additionally, some states require a Certificate of Status before a business can apply for Foreign Qualification.

Who issues the Certificate of Status?

The Certificate of Status is generally issued by the Secretary of State.

When can I request a Certificate of Status for my business?

You will be able to request a Certificate of Status after your LLC is officially formed through the Secretary of State.

Does the Certificate of Status have an expiration date?

The Certificate of Status does not expire/does not need to be renewed.

Swyft Filings can create a Certificate of Status for your New York LLC. Click here for more information.